May 9, 2025 – Dairy cheese remains a staple for many, providing essential nutrients such as calcium and protein. Meanwhile, cheese alternatives, including plant-based options, cater to diverse dietary preferences, offering sustainable and health-conscious choices. As lifestyles evolve, the demand for nutritious, convenient, and innovative cheese products continues to grow.

Innova’s 360 research analyzes the current cheese market trends, highlighting market insights, and consumer preferences that influence the future of cheese and its alternatives globally.

Consumer Preferences

Globally, dairy cheese ranks fifth and non-dairy cheese tenth in product purchases over the past year. Poland, Argentina, Finland, New Zealand, and Sweden are the top 5 countries in dairy cheese purchases, while India leads in non-dairy cheese purchases during the same period. Non-dairy cheese consumption is increasing rapidly, but some consumers feel that it does not meet their expectations.

Cheese trends show that older generations, like Boomers and Generation X, consume more dairy cheese, likely due to the aging population in certain regions like Europe. However, boomers are reducing dairy cheese due to health concerns, like heart disease.

Cheese and Cheese Alternatives Market Trends

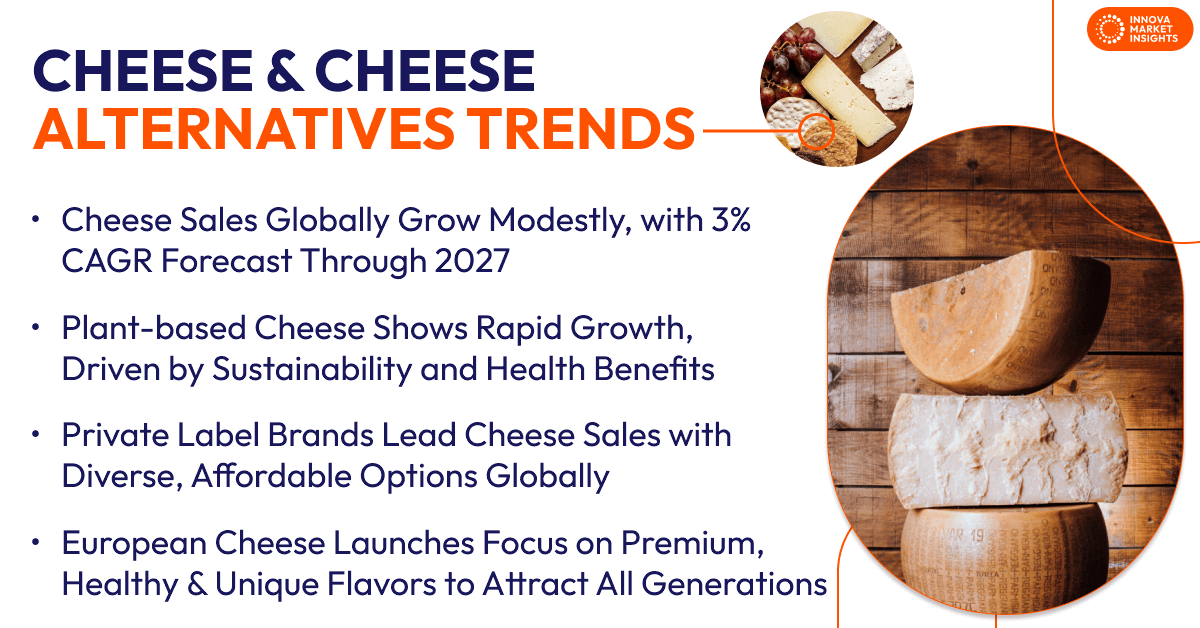

Globally, cheese sales and volume have shown modest growth over the past five years, forecast to grow steadily, with 3% and 2% CAGR through 2027, respectively. Population decline and inflation slow the market growth in several Western regions. Meanwhile, rising disposable incomes, westernized diets, and increased access to retail stores and foodservice outlets drive growth across the global south regions. Greece leads in per capita cheese consumption, followed by France, Estonia, Finland, and Denmark. The preference for a Mediterranean diet, which emphasizes dairy (especially cheese) as the primary protein and calcium source, drives consumption in these regions.

Non-dairy cheese portion remains a small portion of the cheese market but is growing rapidly in Europe and Canada. The benefits of plant-based diets, such as low cholesterol and sustainability, contribute to this trend.

Top Companies and Brands

Private labels lead cheese sales in many regions due to their diverse offerings. Affordable store brands enable major retailers such as Walmart and Kroger to dominate cheese sales in regions like the US. Private label Schwarz has led new dairy cheese launches over the past five years, followed by retailer brand, Lactalis. The top 3 brands in non-dairy cheese are Upfield, Unibel, and Otsuka.

Lactalis’s leading brands are Président, Rondelé, Galbani and Kraft. Their innovations focus on launching protein-enriched products, premium options for new ways to enjoy cheese, and cheese-based meat alternatives.

Cheese and Alternatives Product Launches

Dairy cheese launches have grown at a 5% CAGR, while non-dairy launches outpaced dairy cheese launches, displaying a 15% CAGR over the past five years. The increase in cheese launches reflects demand for variety, including premium, artisanal, healthy, unique flavors, convenient formats, plant-based options, international varieties, and cross-cultural cheeses.

Europe continues to introduce new cheese varieties, offering better-for-you, plant-based, premium artisan, and snacking options. These launches cater to aging populations while attracting younger generations by meeting their demands.

The top 3 cheese subcategories launches in the cheese market are semi-hard and hard, processed, and soft and semi-soft cheese over the past five years. The rise in launches highlights consumers’ growing preference for premium and artisan options, including those supporting charcuterie trays.

Cheese Market Claims Trends

Dairy cheese contains animal-based ingredients, making companies/brands avoid citing vegan and plant-based claims. However, they are increasingly highlighting vegetarian claims in their products. Cheese trends reveal that plant-based claims have increased over the past year, reflecting rising consumer demand and the growing prevalence of plant-based diets. Health claims are higher in non-dairy cheese launches than in dairy launches. Notable claims include gluten-free, lactose-free, and high protein options.

Cheese Flavors and Ingredients Trends

Nearly half of non-dairy launches focus on base ingredients due to labeling law constraints in certain countries. The top base types include cheese, cheddar, mozzarella, cream cheese, and gouda. Cheese top flavors include herb, smoked, garlic, chili, strawberry, truffle mushroom, pepper, jalapeno chili, chive, and vanilla.

Additionally, brands are combining different category flavors with cheese to target premium occasions. This flavor innovation aligns with Innova’s top food trend of 2025, “Wildly Inventive,” which highlights the craving for extraordinary experiences, driving companies to create surprising mash-ups and flavors that attract and delight.

The top ingredients in cheese remain relatively unchanged. However, there has been an increase in fat and oils, thickeners, and starch and modified starch. Manufacturers utilize these ingredients to enhance texture, improve mouth feel, increase meltability, and achieve stretchiness in the products. The generic use of ‘milk’ in packaging reflects the mixtures of cow, goat, sheep, or buffalo milk.

What’s Next in Cheese and Cheese Alternatives Trends?

The cheese and cheese alternatives market are experiencing dynamic shifts as global consumer preferences evolve. Regions like the Middle East and Asia are driving growth due to urbanization and increased demand for convenient and affordable options. Mature markets like North America and Western Europe offer opportunities for innovation, such as healthier formulations and artisanal offerings. Challenges like affordability and lactose intolerance in emerging markets require tailored solutions to ensure broader accessibility.

Brands can prioritize adaptability to seize emerging opportunities. Expanding processed cheese and private label options can address affordability concerns, especially in cost-sensitive regions like Western Europe. Highlighting product safety with claims of real, natural ingredients can strengthen consumer trust. Packaging that shares heritage recipes and authentic methods may resonate with tradition-focused consumers. Innovations in convenience formats, such as mash-ups and portable snacking options, can cater to busy lifestyles. Boosting nutrition with added fiber, protein, or probiotics can appeal to health-conscious consumers. Introducing expanded flavor profiles and artisanal varieties could spark interest in lesser-known regional cheeses varieties.

Lactose-free and plant-based options can continue evolving to offer better taste and texture, breaking barriers for individuals with dietary restrictions. Brands can improve formulations targeting reduced fat, sodium, and sugar content to provide solutions for older generations seeking healthier choices. Brands that balance their cheese innovation portfolio between traditional and trendy products, delivering value-added benefits to all generations, are likely to seize opportunities in this growing market.

This article is based on Innova’s Cheese & Cheese Alternatives – Global report. This report is available to purchase or with an Innova Reports subscription. Reach out to find out more