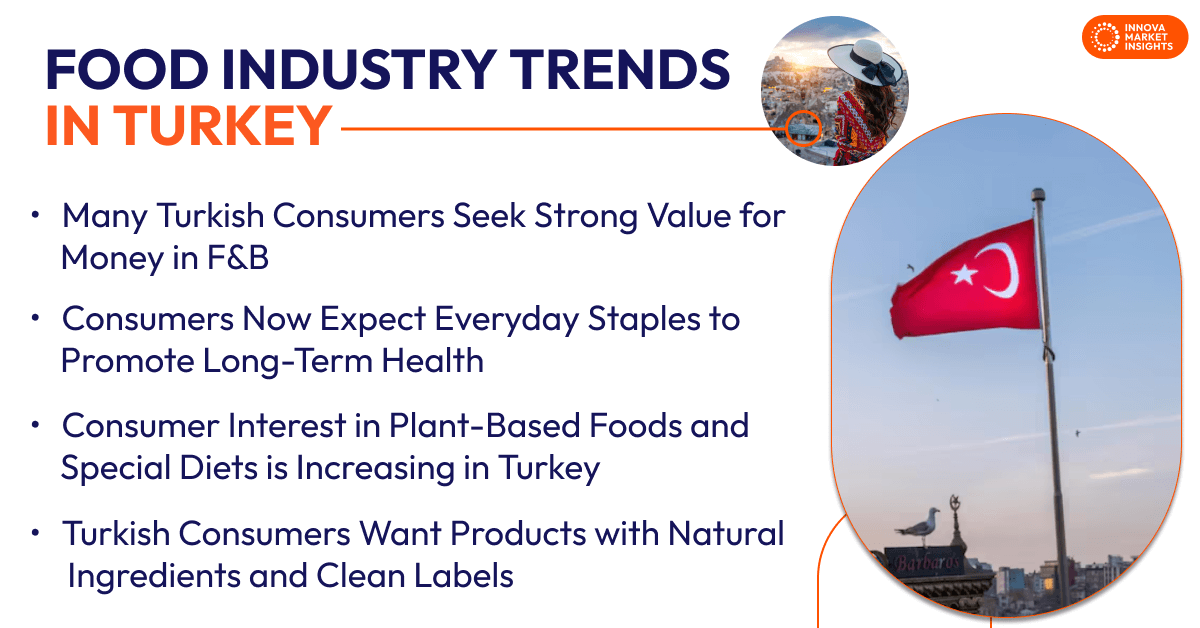

February 11, 2026 – Turkey’s food industry is evolving as consumers navigate economic shifts, changing health priorities, and established culinary traditions. Innova Market Insights explores the main consumer trends driving Turkey’s food and beverage market, including health and clean label expectations, value perceptions, demand for convenience, localization, and the rise of plant-based and special diet options.

What are The Primary Turkish Food Industry Trends Impacting Consumer Choice?

Turkish consumers face growing concerns about personal finances, health, and data security. Technological advances raise issues around job security and privacy, even as they offer new opportunities. Climate change, economic uncertainty, corruption, and political instability add to volatility. As a result, consumers increasingly seek security, reassurance, and greater honesty and transparency from institutions and brands.

How are Turkish Consumers Shifting Toward Alcohol-Free drinks and Moderation?

Budget constraints, health concerns, and moderation are driving declines in beer and overall alcohol consumption in Turkey. For alcoholic beverages, taste, brand, and cost are the top priorities for over 40% of consumers. Ethical issues, along with a desire for variety and changing lifestyles, are driving the growth of non-alcoholic alternatives in Turkey. These alternatives to alcohol are frequently marketed for their safety, natural ingredients, premium quality, and absence of artificial flavors and colors.

Health-Focused and Natural Claims Driving Turkey’s Soft Drinks Market

In Turkey’s soft drinks market, health-focused and natural claims are key purchase drivers. Consumers increasingly choose beverages that emphasize safety, reduced sugar, and the absence of artificial flavors or colors, while seeking products marketed as real and natural. This trend is reflected in the growing popularity of bottled water. In this category, Turkish consumers are attracted to claims of safety, local sourcing, and added vitamins or minerals. For example, a recent launch includes strawberry-flavored sparkling mineral water enriched with minerals and vitamins. These consumer priorities also apply to iced tea, iced coffee, juices, energy drinks, and smoothies. Labels emphasizing organic, plant-based, cold-pressed, and fortified formulations address consumer demand for cleaner, more natural, and health-oriented soft drinks.

How Do Consumers Balance Cost and Quality in Turkey’s Food and Beverage Market?

Budget constraints are making Turkish consumers more selective, leading them to choose products that balance affordability, quality, and taste. In meal preparation, cost and value influence choices across bouillons, sauces, dips, spreads, and ready meals. Turkish food industry trends reveal that over 25% of consumers say cost is a key factor, highlighting increased price sensitivity.

Instead of focusing solely on price, many consumers seek strong value for money: products that are flavorful, fresh, and satisfying within budget. Claims of natural ingredients, product safety, and local sourcing can justify higher prices when they clearly reflect superior quality or health benefits. Brands delivering competitive pricing, natural formulations, no artificial additives, and adequate protein are well positioned to succeed in Turkey’s cost-conscious, quality-focused meal preparation market.

Snacking, Convenience, and On-the-Go Food Trends in Turkey

Turkey’s snack and convenience food market is growing as busy lifestyles increase the demand for practical, time-saving options. Products like snack bars and single-serve packs are preferred when affordable. Brands can cater to Turkish consumer demand for convenient snacking by offering smaller pack sizes, value-oriented options, and cost-effective formulations that maintain taste and quality. Including local flavors and familiar profiles makes sure these products align with Turkish preferences.

Health, Clean Labels, and Functional Foods Shaping Turkish Consumer Demand

Turkish food industry trends show that organic products, strong safety claims, non-GMO positioning, halal certification, and high-protein claims are becoming more important across food categories. Consumers now expect everyday staples to promote long-term health.

In snacks and treats, health and clean label claims strongly influence purchases. Turkish consumers seek benefits like high or added protein and fiber, reduced sugar and fat, and functional ingredients. They favor snacks with real, natural ingredients, free from artificial flavors and colors, and often value organic claims. Halal certification and clear product safety signals build trust in Turkey, while local sourcing reinforces authenticity and quality. These health- and ingredient-focused claims guide choices and support growth, especially in cereal and energy bars.

What Role Does Localization Play in The Success of Turkish Food Products?

Localization and cultural relevance are central to Turkish food industry trends. Consumers increasingly prefer fresh, locally sourced ingredients that improve the eating experience and support sustainability. Products with local taste and authenticity are favored for their connection to Turkish culinary traditions.

Taste and flavor are the top drivers of meal-preparation choices for over 25% of consumers across categories such as bouillons, sauces, dips, spreads, and ready meals. Despite health and budget concerns, Turkish consumers do not compromise on rich, satisfying flavors that reflect local cuisine. Products that deliver strong, authentic taste through real ingredients, balanced seasonings, or premium-quality components are more likely to maintain or grow consumption, particularly in savory and sweet spreads and dips.

How is The Demand for Plant-Based and Functional Nutrition Evolving in Turkey?

Consumer interest in plant-based foods and special diets is increasing in Turkey’s food and beverage market. When purchasing meat and dairy alternatives, consumers prioritize freshness, health benefits, cost, and taste. While meat substitutes and sports nutrition products have slightly lower adoption than the global average, dairy alternatives like non-dairy milk and yogurt are more popular.

Sports and functional nutrition are major growth areas, with 40% of consumers increasing their intake and only 8% decreasing it. Turkish consumers favor sports and functional nutrition products that are high in protein, organic, halal, and made with real, natural ingredients without artificial flavors or colors. In meat replacement products like vegan meatballs, claims such as ‘no additives or preservatives’ and ‘reduced fat’ position products as healthier and in line with clean label trends.

What’s Next for Turkey’s Food Industry and Consumer Trends?

The next wave of growth in Turkey’s food and beverage market will be driven by health-focused, value-conscious, and culturally grounded innovation. Consumers will seek products with natural ingredients, functional benefits, and clean labels that limit artificial additives, preservatives, and GMOs, favoring organic and minimally processed options with clear, transparent communication.

Localization and cultural relevance will be key, driving brands to incorporate traditional Turkish flavors, local sourcing, and halal options. Brands which combine these elements will be best positioned to deliver innovation that feels modern while retaining cultural roots.

This article is based on Innova’s Category Growth Drivers in Turkey report. This report is available to purchase or with an Innova Reports subscription. Reach out to learn more.