September 15, 2025- While fermentation has long been a part of Asian cuisine and is well-established in the food and beverage market, the positioning of these products continues to evolve. New product developments (NPD) in the areas of flavor, health, and texture underscore changes in consumer preferences for fermentation and the health benefits they seek. Innova Market Insights examines these key changes and assesses NPD trends that will shape the future of fermentation in the Asian food and ingredient market.

Fostering Traditional Flavor

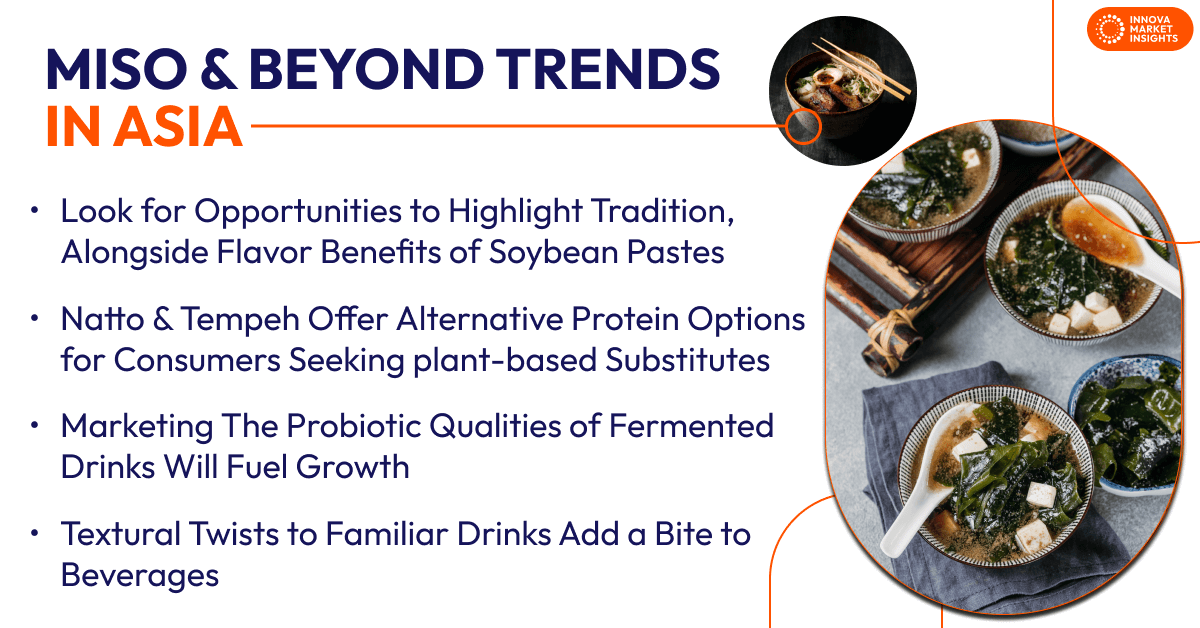

Fermented soybean pastes, such as Japanese miso and Korean doenjang are staples in Asian cuisine, as their umami flavors are integral to traditional sauces, soups, and stews. Across the Asian food and beverage market, miso, in particular, has been rising in popularity outside of Japan, with 21% of miso launches occurring in Europe, 16% in wider Asia (outside of Japan), and 11% in North America, highlighting its global presence.

The miso market is segmented by taste, with different types promoted for different flavor profiles. However, according to Innova’s research, suppliers are shifting their focus in NPD from promoting miso’s flavor benefits to emphasizing its traditional significance in Japanese culture. They are raising the profile of their sourcing and production methods to target consumers seeking traditional, quality offerings. For instance, brands are adding value by marketing products as “local Sapporo miso” or ” traditionally fermented, non-GMO, organic” in launches.

Fermented chili pastes, such as Korean gochujang and Chinese doubanjiang, also offer consumers a combination of traditional umami and spicy flavors. 47% of gochujang product launches are found outside of Korea, highlighting how it is already a significant concept outside of its country of origin. In contrast, doubanjiang remains a niche ingredient that is most popular in Japanese and Chinese cuisine. However, the success of miso and gochujang suggests that authentic Chinese flavors could have a future on the international stage.

Added Protein Benefits

In the Asian food and beverage market, protein delivery is a highly recognized benefit of soy-based products. Furthermore, Asian consumers turn to soy as a source of protein in their diets more often than the average global consumer. In India, China, and Indonesia, 28-48% of consumers report relying on soy for protein, compared to the global average of 19%.

Nattō and tempeh are two examples of fermented soybean products that are rich in protein, fiber, and probiotics. While nattō ‘s NPD is low and centered on Japan, due to its pungent flavor and slimy texture, Innova’s consumer trends research indicates that Indonesian tempeh offers an opportunity for market growth in the plant-based realm. Tempeh absorbs flavors well and can be used as a meat substitute in everyday dishes. As interest in healthy snacking is also on the rise, tempeh chips are also increasingly being positioned as protein and fiber-rich alternatives for Asian consumers.

Kitchen Sauce Staples

Several core sauces used in Asian cuisines, including soy sauce and fish sauce, are derived from fermentation and are kitchen staples across the region. Apart from their status as household mainstays, fermented soy sauces are becoming increasingly important as core flavor components of convenience foods. This is exemplified by the fact that 86-90% of launches list soy and fish sauces as ingredients rather than as a part of the product name or description. From instant noodles and meat snacks to processed poultry and snack mixes, consumers are valuing fermented sauces as trusted building blocks for flavor.

Authentically Korean

Fermented and pickled vegetables are popular in Asian cuisines, but Korean kimchi is the star of the category and is key to expanding Korean cuisine across the Asian market. In the Asian food and beverage industry, kimchi is featured in 38% of pickled condiment and chutney launches, 19% of instant noodle launches, 6% of seasoning launches, and 5% of ready meal launches, demonstrating its wide appeal in both its natural and ingredient forms.

When it comes to health claims, Asian suppliers currently deliver relatively subtle probiotic messaging. However, brands like Daesang Jongga, which claims to be the number one kimchi brand in Korea, are increasingly highlighting these benefits. This suggests a greater potential for more health messaging in fermented vegetable offerings like kimchi.

Beverages for Health

Of the wide range of fermented products available in the Asian food and ingredient market, beverages are the category most targeting the probiotic benefits of fermentation. Chinese consumers are particularly drawn to these health advantages, with 48% of consumers ranking probiotics as the #1 choice of ingredients for gut health. Chinese and Indian consumers also name probiotics as a key ingredient for delivering mental health benefits, demonstrating another avenue for marketing fermented drinks to Asian consumers.

Kombucha is an example of a traditional fermented tea drink that has recently gained popularity. Asia is the second-most important region for kombucha NPD, and 28% of positioning claims in kombucha launches promote its inherent probiotic benefits, with organic, traditional, and sugar free health claims following closely behind. Kombucha’s recent success in Asia is very much driven by health awareness, and claims relating to its healthy formulation, as well as naturalness and tradition, will continue to be important to its future success.

Texture Phenomenon

Nata de coco is favored for its sweet and slightly tangy flavor. However, its jelly-like consistency has driven increased levels of NPD in recent years. Produced from the fermentation of coconut water, nata de coco possesses a mild, sweet and slightly tangy flavor with subtle notes of coconut. Originating in the Philippines, the gelatinous confection has spread beyond Southeast Asia to the wider Asian food and ingredients market, and its current popularity is driven by its ability to add textural value to everyday drinks. Asian consumers are increasingly excited about textural twists to familiar beverages, and the incorporation of cubes or pieces of nada de coco adds bite to beverages. In Asia alone, 39% of nata de coco product launches are attributed to the soft drinks category, a notable increase from just 21% in 2020.

What’s next in fermented food and ingredients in Asia?

Internationally, fermented foods are positioned more firmly on health platforms than in Asia, due to their traditional nature. However, more can be done to spotlight their health benefits to consumers, by including clear health messaging on packaging. Additionally, since fermented foods have long been a part of Asian cuisine, the market has yet to fully explore offerings native to Western markets. Kefir and sourdough have garnered more attention in the global food and beverage market, so they could offer future potential for expansion in terms of health and taste platforms.

This article is based on Innova’s Miso & Beyond: Fermented Food & Ingredients Trends in Asia report. This report is available to purchase or with an Innova Reports subscription. Reach out to find out more