February 17, 2026 – The US supplements market has seen steady growth over the past five years and is likely to keep expanding. Hybrid supplements and bundled products are becoming more popular because they meet several needs at once and make choices easier. New research in gut health, healthy aging, and nutrient delivery is also driving the rise of hybrid supplement products and mixing up traditional categories. Innova Market Insights tracks these changing trends in the US supplements market.

What is The Role of Supplements in Holistic Wellness?

US consumers see supplements as their fourth choice for improving health, after being more active, getting more sleep, and changing their diet. As people become more aware of the risks of overprocessed foods, they are turning to better nutrition through both food and supplements. US brands can present supplements as part of a complete holistic wellness plan that also includes exercise, whole foods, and sleep. Some programs now combine nutrition counseling and supplements with GLP-1 drug treatments.

Women and Supplement Usage: Awareness vs. Engagement

Supplement trends reveal that women in the US say they know more about supplements, but men are more likely to use them, especially those aimed at performance and productivity. These types of claims do not work as well with women and may need a new strategy. To reach women better, brands should highlight holistic wellness, stress relief, hormone balance, and needs at different life stages like pregnancy, menopause, and aging. Being clear and using scientific evidence is also important.

Ingredient Awareness in Supplements: Closing the Gap Between Familiarity and Usage

Ingredients like ashwagandha, holy basil, and lion’s mane mushroom are getting more attention in the US supplement market, but people do not always use them. Often, far fewer people use these ingredients than know about them. This gap gives brands a chance to link these ingredients to clear health benefits and wellness goals. People are more likely to try ingredients they already know, especially if they are found in common foods and drinks. Brands can make these ingredients more appealing by educating consumers about their effects, safety, and proper use, while also reminding them of familiar ingredients and introducing new ones.

How Do Supplement Trends Differ by Generation?

Since health and wellness often change with age, brands need to consider what different generations want. Supplement trends suggest that Millennials, who are getting closer to middle age, are starting to care more about supplements for weight and sleep. Generation Z is less interested, probably because they are younger and healthier, but they still care about energy and sleep quality. Brands can appeal to everyone by offering products with combined benefits, better value, and new, interesting claims for each age group.

Hybrid and Blended Supplement Categories: The Rise of Multifunctional Products

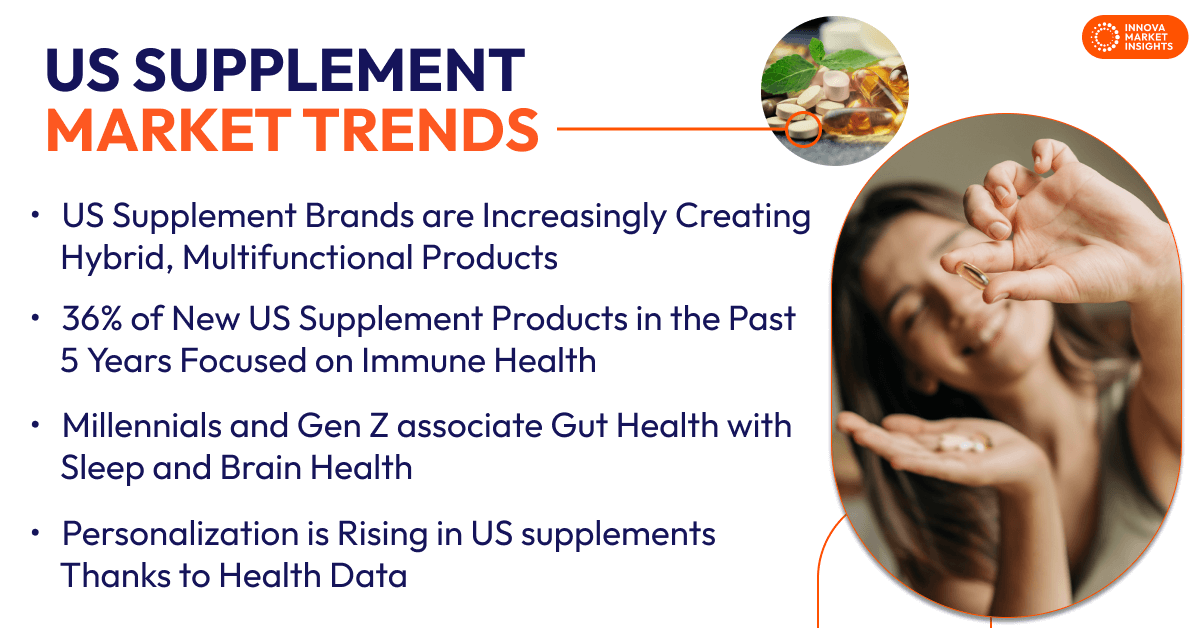

Brands in the US supplement market are now mixing ingredients to meet several health and wellness needs with fewer products. For example, multivitamins and immune support supplements often include ingredients that boost mood or brain function. Bundled products are showing up in both mainstream and specialty markets, creating new options that do not fit old categories. These hybrid supplements allow for more claims on labels, and personalized supplement stacks based on health data are moving away from the one-size-fits-all model.

How Does Technology Enable Supplement Personalization?

Data from wearable technology, health questionnaires, tests, and DNA analysis is useful for supplement innovation in the US. This data helps create a new tier of lifestyle offerings that combine proprietary and semi-custom options. Furthermore, as consumers engage more with their health data, demand is rising for individualized counseling and tailored holistic wellness plans. Brands in the US are responding with prescriptive supplements based on biomarkers, or personalized stacks aligned with specific wellness objectives. For example, Bioniq offers two tiers of personalized supplements: BioniqGo, based on individual health goals and questionnaires, and BioniqPro, tailored to blood markers.

What are The Key Gut Health Supplement Trends in the US?

As more research shows a link between gut health and overall wellness, interest among US consumers is rising. There are clear generational differences: more than half of Generation X and Boomers see gut health as tied to weight control, while millennials link it more to sleep, and about a third of Gen Z and Millennials connect it to brain health. Supplement trends indicate that many people in the US use fiber, probiotics, and vitamin D for gut health. New products often mix familiar and new ingredients, like combining prebiotics and postbiotics with probiotics, but people still need more information about the benefits. For example, Daily Nouri Feelfull is a lemon-flavored prebiotic fiber supplement that helps gut health, appetite control, and metabolism by making you feel full.

What are The Top Health Claims in New US Supplement Launches?

About 36% of new supplement products in the US over the past five years have focused on immune health, showing the impact of events like COVID-19. Supplement trends show that more than a third of people in every generation are interested in energy and stamina, which gives brands a chance to offer energy-boosting supplements. For example, Ryde Function Energize Dietary Supplement with Tropical Flavor uses green tea caffeine, taurine, ginseng extract, and vitamins B1 and B6 to boost energy. Brands in the US supplement market can also attract Millennials by focusing on sleep quality and teaching other groups about its benefits. Brain health, including focus, memory, clarity, and calm, is often linked to mushrooms like lion’s mane. The new LegendairyMilk Clever Girl Rhodiola Lion’s Mane Cognizin Dietary Supplement in the US includes lion’s mane to help with cognitive function.

What’s Next in US Supplement Market Trends?

The US supplements market is entering a new phase that requires brands to hybridize, personalize, and integrate products into broader wellness routines. Supplement brands in the US are innovating with hybrid 2-in-1 and multi-benefit formulations. At the premium level, subscription-based, bespoke offerings informed by DNA biomarkers are emerging, often paired with fitness coaching, lifestyle support, and medical vetting. More accessible mid-tier “lifestyle stacks” use questionnaires for scalable personalization. The lines between functional, essential, and botanical ingredients are blurring as supplements expand into food, beverage, and beauty categories, reinforcing themes such as inner beauty, gut microbiome support, and targeted organ health. To sustain growth and build trust, supplement brands must increase education and marketing about ingredient roles and strengthen partnerships with healthcare and wellness providers as part of the evolving functional wellness movement.

This article is based on Innova’s Supplements in the US & Canada report. This report is available to purchase or with an Innova Reports subscription. Reach out to learn more.